As we come to the close of 2023 and look ahead to the new year, many questions linger. Where can we expect interest rates to settle? How far will cap rates expand in response to the uncertain debt markets? How long will it take for the expansion to drive sales volumes back up?

Most importantly, what can owners do to protect their assets from the often sudden changes in economic conditions? While no one has a crystal ball, there are certain trends to keep an eye on as we transition into 2024.

Knowing what to look for in the economy and market will not only allow owners to prepare for various possibilities but also avoid being blindsided by further shifts in the market.

State of the Market and What to Watch

According to data from CoStar Group, nationwide sales across the five main property types fell 53% in the first nine months of 2023 compared to the same period last year.

The sectors more sensitive to rising interest rates such as multifamily, office, and hospitality fell 65%, 57%, and 58% respectively during this period. Industrial sales fell by 44% and retail by 37%.

As we know, this is due primarily to the rise in interest rates.

Fortunately, the Federal Reserve left interest rates unchanged at their monetary policy committee meeting on November 1st. This was the second consecutive meeting where the central bank abstained from an increase in its current policy-tightening cycle. Looking ahead to 2024, eight meetings are scheduled to set the federal funds rate starting on January 31st.

Many believe the Fed will continue to pause further rate increases while they observe how the U.S. economy continues to react. When they might resume increases depends on key economic indicators such as inflation rates, GDP growth, and employment levels.

Taking a closer look, the past eighteen months of rate hikes have slowly curbed inflation, which came in at 3.7% as of September 2023. The Fed’s goal of 2.0% inflation seems to be in reach, but it’s still being held back by other factors such as consumer spending which has remained robust and led to an increase in the prices of goods and services.

Many economists predict consumer spending to level out as the costs of leisure activities and regular consumer goods continue to rise. American credit card debt being at an all-time high (surpassing $1T) should also factor into the anticipated decrease or at least flatten spending.

If you’re making decisions based on predictions of future federal funds rate decisions, the main things to keep your eyes on are inflation and consumer spending.

Cap Rates Now and Down the Road

With the federal funds rate currently at 5.25% - 5.50%, interest rates for commercial properties are in the 6.75% - 8.00+% range depending on property details, loan terms, and the lender.

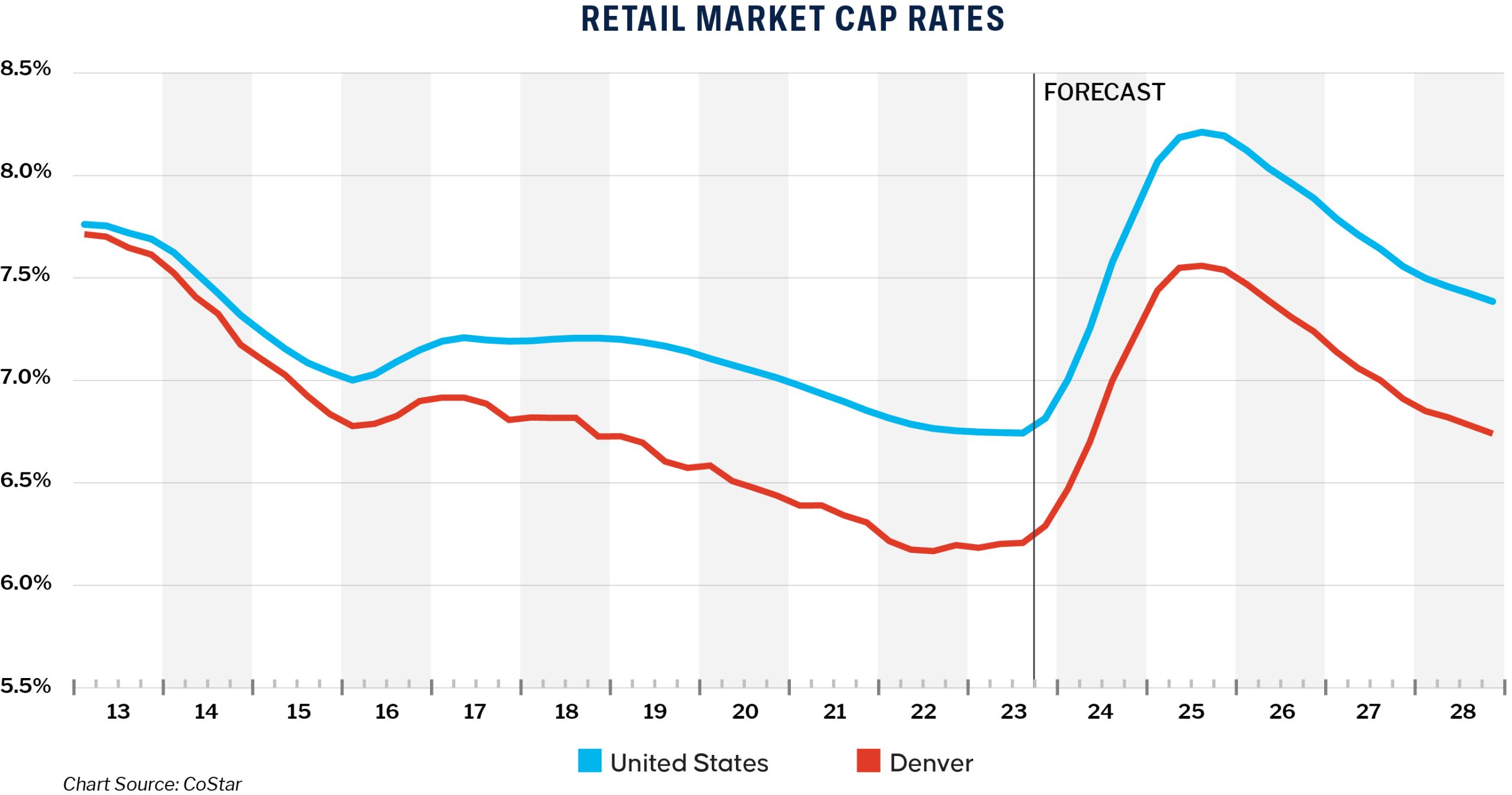

This change has slowly led to an expansion in cap rates across all property types. According to CoStar, the average cap rate for all U.S. retail sales was 6.74% in Q3 2023. The average for the Denver MSA in the same period was 6.20%. In looking at the overall average for retail sales in Denver and nationwide, the cap rates have not increased enough for underwriting with current debt to meet sellers’ pricing expectations. This is reflected in the steep decline in 2023 sales.

Looking ahead, CoStar forecasts an increase in the average cap rate for all Denver retail sales, potentially reaching 6.46% in Q1 2024 and 7.43% in Q1 2025. The U.S. average for retail sales during the same two quarters is forecasted at 7.00% and 8.07% respectively.

If these projections prove to be true, investors with significant buying power during this time are expected to “buy low” into the overall market as CoStar predicts the cap rates on retail sales will plateau in mid-2025 and start to decrease in 2026.

However, many investors are currently waiting “on the sidelines” to see what the market does next. Once the Fed’s rate hikes level out, investors are likely to become more comfortable with the lending environment and begin to place more and more capital.

While the market is stuck in this “price discovery” phase, now is a good time for landlords to do a deep dive into the performance of their properties and plan for the next few years.

According to the Wall Street Journal & Trepp, approximately $1.5 trillion in commercial loans will be coming due in the next three years. Owners should be underwriting what their debt coverage ratios will be (at current or projected interest rates) to get a conservative idea of what’s to come.

If rate hikes persist, those with loans coming due may be at risk of a dangerously low DCR or even negative leverage during a refinance. This might motivate owners to consider sales instead of refinance depending on their basis, original interest rate, and in-place net operating income.

Key Takeaways & Next Steps

As everyone waits for the FOMC’s meeting on January 31, 2024, cap rates should continue to trend upwards nationwide and here locally. The cost of capital is expected to increase as well.

With an expected leveling out of these conditions happening later in 2025 and early 2026, the ability to acquire assets during this time could prove to be a great long-term investment strategy.

Those who are still weary of uncertain economic conditions should take this time to look at their current investments as well as the macroeconomic drivers that are affecting the Fed’s rate hike decisions. The quicker the Fed can slow down the economy, the quicker Americans should see rates level out and transaction volume pick back up.

As featured in Colorado Real Estate Journal.

Josh Lorenzen

Blue West Capital

Josh@BlueWestCapital.com

720.821.2520

Be the first to know about new investment properties.

Subscribe to our mailing list