written by Shawn Dickmann

45 days and $1,000,000 on the line. We have all been there. It is a stressful time, even for the most sophisticated investors. Yes, we’re talking about the dreaded 1031 Exchange and the 45 days to identify a property. No one wants to write Uncle Sam a check.

Blue West Capital works with 1031 investors, many of whom sold an asset in a market that has experienced high appreciation over the past five years, such as Colorado, Arizona, Texas, Utah, California, and Florida. Investors consider - should they buy in the same high appreciation market? Should they accept an aggressively low cap rate for that high appreciation market? Should they hope for continued high appreciation? Or should they consider buying a property in a different market with higher cash flow and less potential appreciation?

On average a multi-tenant retail property in Kansas sells for a 7.5% cap rate, while in Colorado, the same property averages a 5.9% cap rate. Unless the buyer is all cash or has a low loan to value, buying a Colorado property will bring negative leverage that reduces the property’s cash flow. While in a Midwest state, like Kansas, a buyer can still find quality assets with positive leverage. On the contrary, states like Colorado historically have experienced more appreciation through cap rate compression and rental rate growth. Over the past five years in Colorado, rental rates for retail properties have increased by roughly 28% while only 12% in Kansas. In 2019 the average retail property in Kansas sold for a 9.1% cap rate, however in Colorado it was 6.8%. Over the past four years, cap rates in Kansas compressed by 160 basis points, and 90 basis points in Colorado.

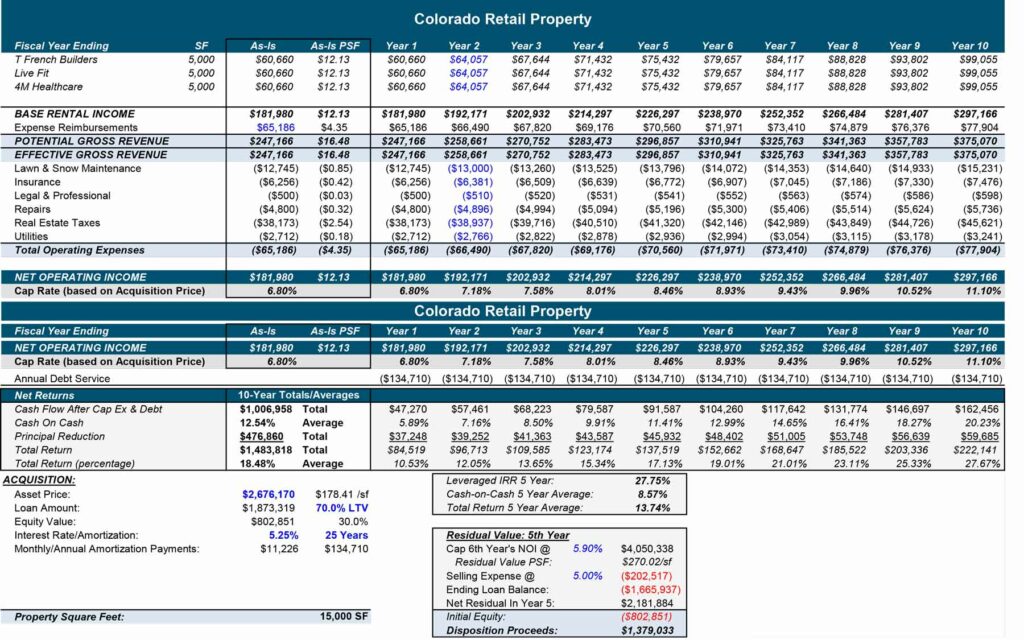

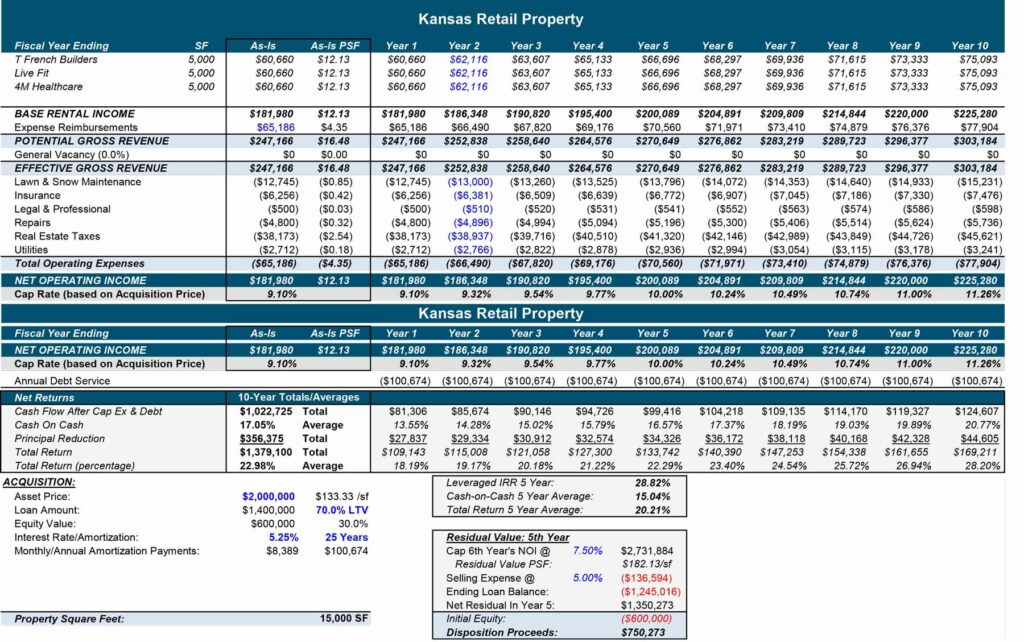

Everything being equal, five years ago, if an investor purchased a multi-tenant retail property with a net operating income of $181,980, in Colorado it would have cost $2,676,000 at a 6.80% cap rate. The same property in Kansas would have cost $2,000,000 at a 9.10% cap rate. After holding the property for five years, an owner would have sold the Colorado property for a 5.90% cap rate or $4,050,000. The Kansas owner would have sold it for a 7.50% cap rate or $2,731,000. It sounds like the Colorado property was the obvious winner. Maybe not. If the goal was just appreciation, then yes, Colorado was the better state to invest in. If the goal was cash flow, then the Kansas property produced $107,140 more in additional cash flow in the first five years. When you compare the investments with a leveraged five-year internal rate of return, the Kansas and Colorado property performed relatively the same. 28.82% for Kansas. 27.75% for Colorado.

Colorado Retail Property

Kansas Retail Property

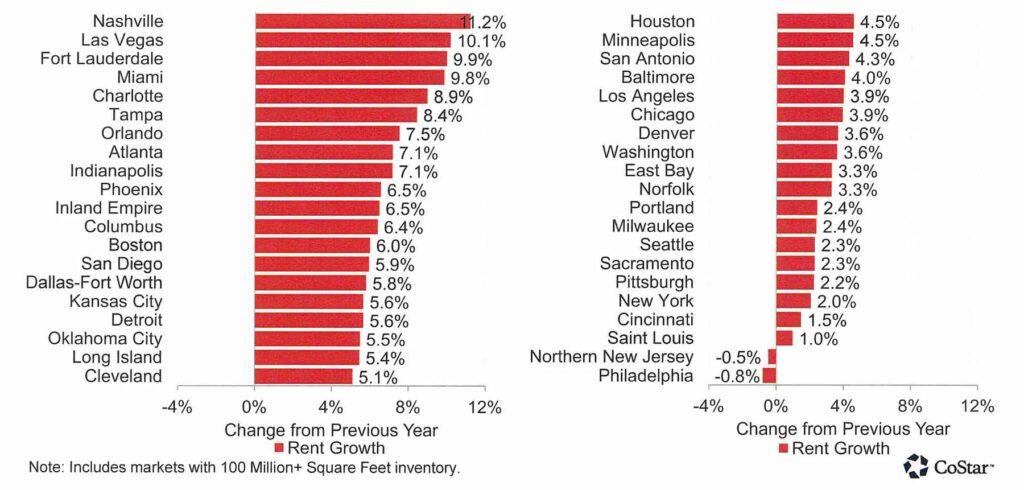

Investors looking for growth markets should consider investing in Nashville, Las Vegas, Fort Lauderdale, Miami, Charlotte, Tampa, Orlando, Atlanta, Indianapolis, Phoenix, Dallas-Fort Worth, Kansas City, and Oklahoma City.

Investors looking for higher cash flow should consider investing in Kansas, Missouri, Arkansas, Ohio, Minnesota, Wisconsin, Michigan, and Indiana.

Rent Growth, by Market

If you’d like additional information to help identify these markets, please reach out to Shawn Dickmann of Blue West Capital.

Ready to learn more about 1031 Exchange?

Be the first to know about new investment properties.

Subscribe to our mailing list