“Location, location, location…” It’s the real estate mantra we’ve all heard. And while some argue it’s the most important factor in a deal, I’ve never believed it tells the whole story. Concepts, trends, and fads come and go. The dirt might stay the same, but that’s not what we’re really after.

What matters most are the fundamentals.

In net lease retail, true value isn’t just about a great corner. It’s built on what sits behind it: tenant strength, lease structure, adaptability, rent growth, and a clear exit strategy. These are the levers that drive performance and protect against risk.

A Case Study in Fundamentals: Walgreens

When I started in this business, Walgreens was considered the “gold standard” of net lease retail. Their 20-year leases, investment-grade credit, and prime corner locations made them a top-tier tenant. They even had the tagline: “the corner of happy and healthy.”

Fourteen years later, a lot has changed. We’ve seen credit downgrades, store closures, failed acquisitions, and now, a $10 billion sale to Sycamore Partners that will take the company private.

I had a mentor early on who drilled the fundamentals into me. Because of that, I’ve never recommended Walgreens to a buyer. I’ve sold plenty on behalf of owners, but unless pricing was a steal or the store was dark, they never made sense. The rents were inflated, the ±14,000 square foot prototypes were proprietary, and the leases could stay flat for decades with no inflation hedge.

Great corners, sure. But the fundamentals were off.

This latest shake-up is a reminder that there is no perfect tenant or perfect deal. It's easy to chase the next hot concept, but real value comes when you peel back the layers and focus on the full picture.

Not Just Mailbox Money

On the surface, net lease investing seems like it should be simple. We have clients from all walks of life, and one of the things we enjoy most is educating them on this specific corner of the real estate world.

Some of my favorite clients are the ones who walk in saying they want to buy a NNN deal and collect the “mailbox money.” While that may be the end goal, they’re usually surprised to learn it’s more nuanced than that.

Our conversations start with a few basics: price point, return goals, and geographic preferences. We also try to identify tenants or concepts they like or want to avoid.

Once we understand their goals, that’s when the real work begins. Every deal has to be viewed through the lens of the worst-case scenario. There might be a long-term lease and a stable tenant in place today, but what happens if you wake up tomorrow and the building is vacant?

That’s the scenario we are solving for when we focus on the fundamentals.

Lease Type and Return Profile

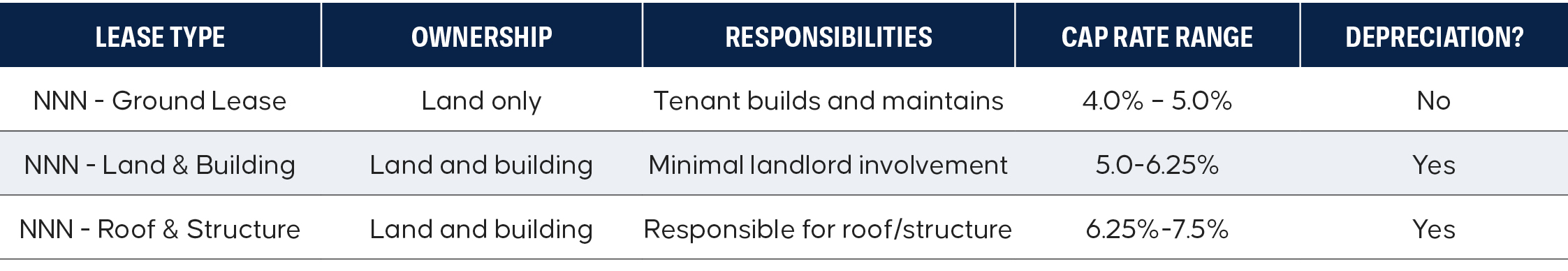

Lease structure drives everything: pricing, depreciation, landlord responsibility, and long-term risk. In net lease retail, most deals fall into one of three primary formats:

What to Analyze Before You Buy

Once a client knows what they want to own, we dive into the details.

We evaluate tenant credit, lease terms, rent structure, and option control. Then we assess the property: lot and building size, site layout, access points, traffic patterns, co-tenancy, restrictions, easements, drainage, and the condition of systems like HVAC and the roof.

But it doesn’t stop at the checklist. We ask whether the tenant is in the right prototype. Are they expanding or contracting? Is the building flexible, or is it a one-off design?

There’s no such thing as a perfect deal. The goal is to mitigate as many risk factors as possible. It only takes one to kill a deal. A deep understanding of the fundamentals is how we make sure the investment supports the client’s long-term strategy.

Know Before You Close

To keep our analysis focused, we group it into three buckets:

Tenant and Lease

☐ Investment-grade credit

☐ Favorable rent escalations

☐ Lease term and renewal options

☐ Inflation hedge

Real Estate

☐ Strong visibility and traffic

☐ Site plan supports long-term use

☐ No major easements or restrictions

☐ Quality surrounding tenants

Building Condition and Use

☐ Roof and HVAC in good condition

☐ Tenant in the right prototype

☐ Space is reusable

Why Adaptability Matters

Adaptability is one of the biggest differentiators. If a tenant leaves, how easily can you re-lease the space? Generic prototypes with flexible layouts almost always outperform custom builds with limited appeal.

We also favor leases with rent bumps or inflation adjustments. Flat leases might seem predictable, but they quietly erode returns over time.

Final Thought

The Walgreens example is a clear reminder that location alone is not enough. Real performance comes from understanding every layer of a deal. Tenant strength, lease structure, adaptability, rent growth, and a defined exit strategy are the fundamentals that determine whether an investment holds up over time.

At Blue West Capital, we help investors take a deeper and more strategic approach to net lease retail and industrial. If you are exploring ownership in this space, we’d love to connect and talk through what the right fundamentals look like for you. Contact us for expert guidance and strategic insights.

As featured in Colorado Real Estate Journal.

Brian Wolfman

Director, Investment Sales

Brian@BlueWestCapital.com

720.464.1598

Be the first to know about new investment properties.

Subscribe to our mailing list