written by Brandon Wright

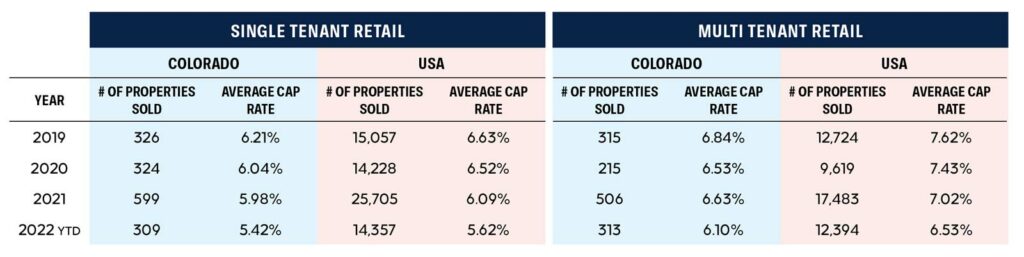

Retail properties in Colorado have experienced significant cap rate compression over the past five years and are selling for premiums compared to most markets across the country. Since 2019, the average cap rate for a single tenant retail property in Colorado has compressed by 79 basis points, while cap rates for multi-tenant retail properties have compressed by 74 basis points. Through September 2022, cap rates this year for single tenant and multi-tenant retail properties in Colorado averaged 5.42 percent and 6.10 percent, respectively. Nationally, the average cap rate for these two property types was 5.62 percent and 6.53 percent.

Cap rates in Colorado have remained compressed despite various headwinds facing the market. There’s a notable supply and demand imbalance of high-quality properties. The limited inventory of available properties and strong national demand for properties located in Colorado, has helped keep cap rates near record lows. Public and private REITS, family offices, high-net-worth individuals, and 1031 exchange investors remain optimistic on Colorado for its long-term upside and growth, and are looking to deploy capital here.

Colorado has a vibrant and diverse economy as well as strong demographics, which include a young and educated workforce. Colorado is ranked the fifth most educated state according to WalletHub and ranks second in the country for highest percentage of bachelor’s degree holders. It was also ranked the fourth best state to do business in 2022, according to CNBC. Between 2010 and 2022, the population of Colorado grew by 14.8 percent adding nearly one million new residents. By 2030, Colorado’s population is projected to increase by over 700,000 new residents, a 12 percent increase. In the last twelve months, $2.3 billion of retail properties sold in Colorado, a substantial increase when compared to the five-year annual average of $1.4 billion.

Rising interest rates, inflation, and the possibility of a prolonged recession are all headwinds facing the national real estate market and applying upward pressure on cap rates. In the coming months, we expect cap rates to continue to rise and transaction volumes will continue to decline nationally. Property valuations in Colorado should fare better than most markets nationally due to the forecasted growth and positive long-term investor sentiment. However, the ride may become choppy in the near term and may offer buyers with available cash a great opportunity to acquire quality commercial investment properties.

Be the first to know about new investment properties.

Subscribe to our mailing list