With commercial property values plummeting 21% since interest rate hikes, a prime opportunity for private investors looms.

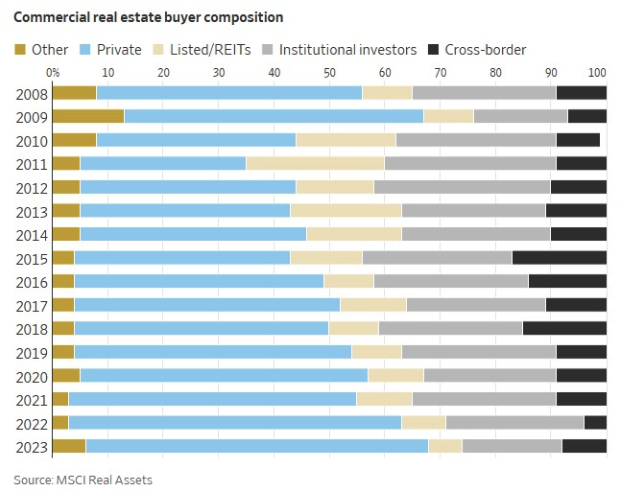

Taking the lead: Private investors, notably high-net-worth individuals and family offices, have stepped up accounting for 60% of U.S. commercial real estate transactions in the past two years. This marks a significant uptick from their historical average of 46% post-global financial crisis. Meanwhile, institutional investors have receded, contributing to only 18% of deals, deterred by previous losses and liquidity constraints in their private equity holdings.

Why it matters: The trend underscores the advantage of being nimble and less constrained by the need for committee approvals or short-term returns. Private buyers, with their long-term outlook and ability to act swiftly, are positioned to capitalize on the downturn. Following the global financial crisis, private investors dominated U.S. real estate, making 54% of purchases in 2009. Values bottomed out in Q2 2010, rewarding early buyers with a 9% annual return over a decade, vs. the 4.5% returns of those who waited until 2013 for the market to recover.

Lessons from the past: Bold investors like Blackstone made big bets following the GFC acquiring tens of thousands of foreclosed homes in 2012, a decision that greatly paid off. Similarly, RXR invested $4.5 billion in U.S. office spaces between 2009 and 2012, doubling its capital despite the market's uncertainty and the initial gamble of buying properties occupied by major banks like JP Morgan during financial turmoil. Despite the current ambiguity surrounding office space vacancy, the high rewards of investing in downturns are clear.

THE TAKEAWAY

Making the most of it: Large funds are currently hamstrung by $3.2 trillion in immobile private equity assets due to a slow dealmaking and IPO market, delaying investor returns. As institutions wait longer to get their money back and re-enter the property market, early private investors will have already secured most of the prime deals. Echoing Warren Buffett's counsel to "Be fearful when others are greedy, and greedy when others are fearful," the question arises: Is the current level of fear in the market a signal for opportunistic buying?

Reach out to learn how we can help you take advantage of this unique market.

Be the first to know about new investment properties.

Subscribe to our mailing list