With the 2024 election now behind us and President-elect Donald Trump set to take office in January, uncertainty around interest rates is intensifying. The day after the election, the 10-Year Treasury rate rose by 14 basis points to reach 4.433%—a move investors anticipated, reflecting the market’s response to potential Republican-led tax cuts and tariffs.

In recent months, the Federal Reserve has been tweaking interest rates to stabilize the economy in light of economic pressures. After a period of 11 rate hikes from 2022 to 2023, which pushed rates from near-zero to a range of 5.25-5.50% by mid-2023, the Fed made a shift in September 2024 with a 50-basis point cut—the first rate reduction since early in the pandemic. This was followed by a smaller 25-basis point cut in early November, bringing the target range down to 4.50-4.75%. These adjustments are the Fed’s attempt to support growth while tackling inflation as the economy enters a new phase.

Understanding how these Fed moves influence commercial real estate (CRE) lending is crucial for investors. The federal funds rate and inflation often move in opposite directions: when inflation rises, the Fed increases the rate to make borrowing more costly, which helps cool down spending and lending, ultimately controlling inflation. At the beginning of the COVID-19 pandemic, though, the Fed cut rates to near-zero to encourage spending and stimulate the economy. This approach worked but contributed to the highest inflation rates in over 40 years—by June 2022, inflation hit 9.1%, the highest level since 1981.

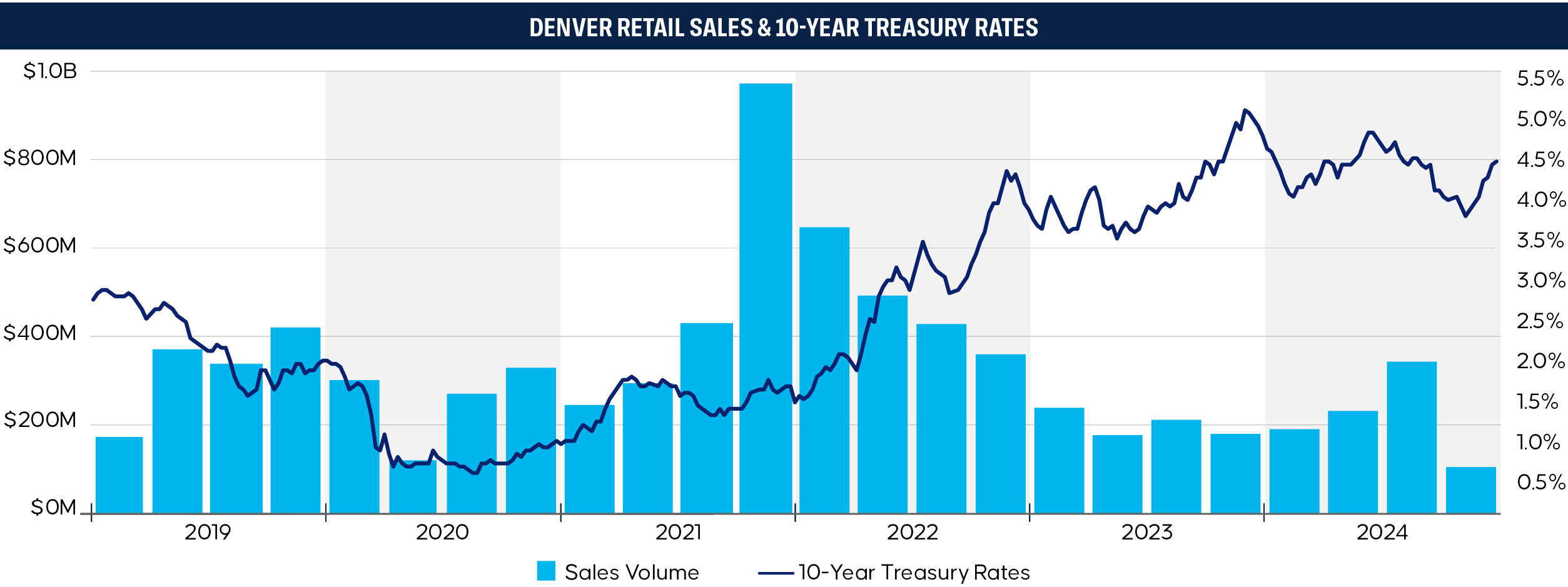

This low-rate environment during the pandemic also spurred a surge in CRE transactions, as borrowing became cheaper. In Colorado, retail property sales climbed to 2,200 transactions in 2021. But as rates increased, deal volume declined: 1,742 sales in 2022, 1,231 in 2023, and 1,035 so far in 2024. This drop mirrors the rising costs of borrowing, illustrating how higher rates have cooled the market. When you look at Denver’s retail sales alongside the historical 10-Year Treasury trends, the connection is clear—higher yields often lead to fewer transactions.

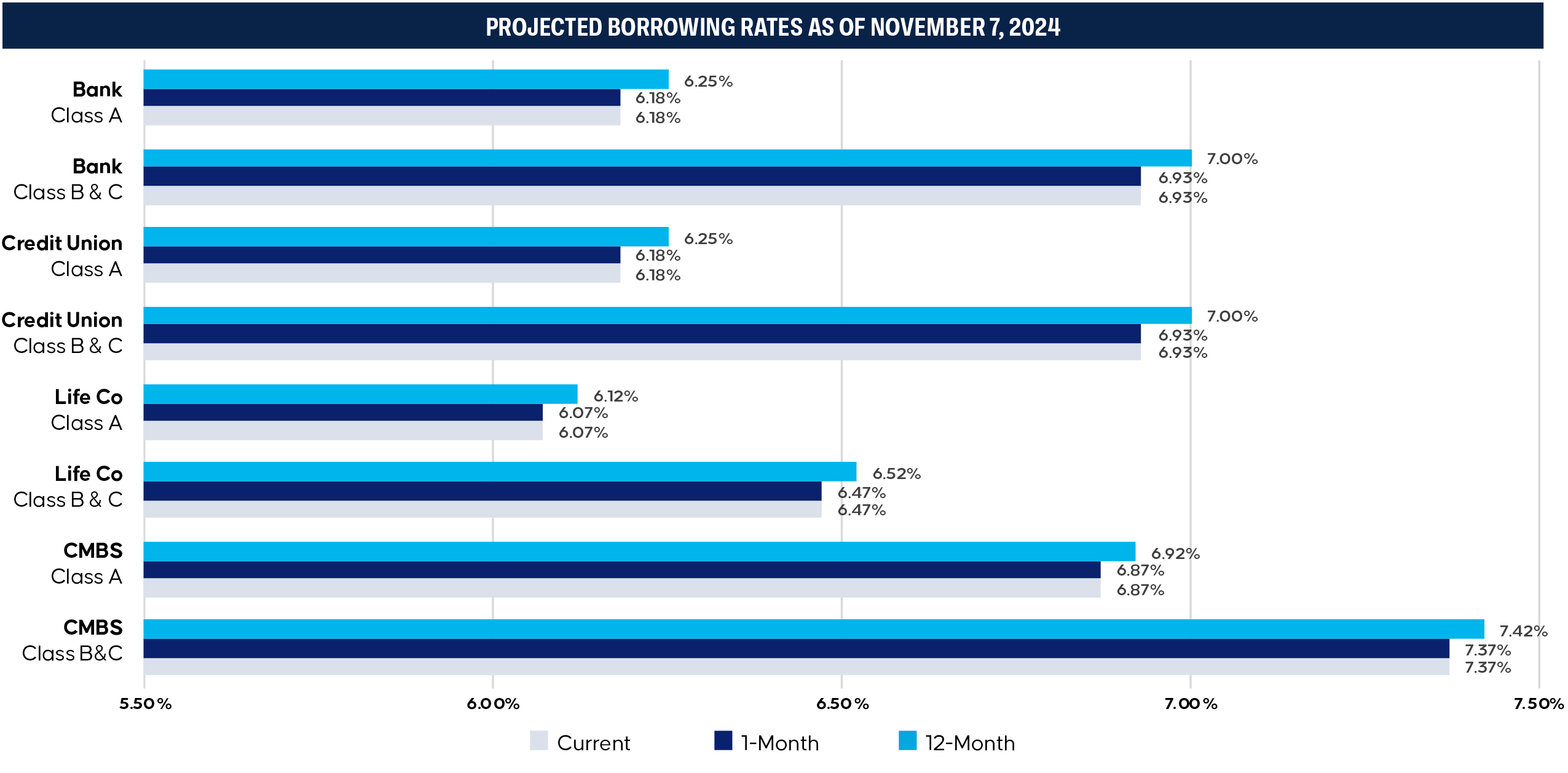

It’s worth noting, though, that the federal funds rate doesn’t directly set CRE lending rates. These loans are generally based on spreads over the 5-Year and 10-Year Treasury yields. Lenders like banks, credit unions, and insurance companies use these Treasury yields as benchmarks, adjusting their spreads depending on market conditions. This means that cuts to the Fed’s rate don’t necessarily translate into immediate rate drops for CRE loans. For instance, despite the Fed’s cuts in September and November, CRE lending rates held steady, with the 10-Year Treasury even gaining 6 basis points following the September cut to reach 3.702%. Treasury yields often reflect expected rate changes for the coming year, so lenders typically base decisions on these forward-looking indicators rather than on Fed actions alone.

Looking ahead, projections from Derivative Logic suggest that the 5-Year and 10-Year Treasury rates will continue to rise. For CRE investors, this implies that interest rates might remain high for a while. Investors hoping for lower rates may need to wait longer, as elevated Treasury yields could keep CRE lending rates high in the near term. While this news may be disheartening, it reflects an economic environment where inflation concerns and policy moves are maintaining pressure on long-term borrowing costs.

On the positive side, recent data from the Bureau of Labor Statistics offers a hint of relief: inflation has been gradually easing, with rates rising only 0.2% across July, August, and September 2024. If this trend holds, the Fed could have more room to continue lowering rates into 2025 or even 2026. Current CME Group data suggests a 68.1% chance of another 25-basis point cut at the FOMC’s December meeting, which could lower the target range further to 4.25-4.50%. Of course, unforeseen events—like pandemics, conflicts, or major policy shifts—could disrupt these trends.

While long-term projections are never guaranteed, any future rate cuts would likely support a rise in retail transactions and possibly lead to lower cap rates as inventory backlogs clear. Currently, retail cap rates are elevated, partly due to a surplus of available assets built up over the past year. Analysts anticipate that as backlogs clear, cap rates may gradually come down.

For now, many brokers and investors have adopted a “survive till 2025” mindset, blending resilience with optimism. The CRE market, especially within the net lease sector, is adjusting to a high-rate reality while keeping an eye on future opportunities. The backlog of retail properties signals that market conditions will remain tough, but inflation tapering and potential rate cuts give reason for cautious hope.

As the market prepares for a stretch of elevated rates, investors are exploring strategic opportunities with cautious optimism. While the road ahead may still be challenging, the potential for gradual rate cuts and declining inflation could bring much-needed relief to the CRE market.

Have questions about navigating today’s CRE market? Contact us for expert guidance and strategic insights.

As featured in Colorado Real Estate Journal.

SOURCES:FederalReserve.Gov, US Bureau of Labor Statistics, DerivitativeLogic.com

Noah Harrison

Senior Analyst & Associate, Investment Sales

Noah@BlueWestCapital.com

720.464.7488

Be the first to know about new investment properties.

Subscribe to our mailing list